When is it the best time to refi? When should you consider it? Read this article to get a better idea.

Published on 03/06/2024

In today's challenging financial landscape, debt consolidation through refinancing can be your path to a brighter financial future.

Published on 03/05/2024

Find out how by rearranging just a few financial puzzle pieces, you can transform that "dream home" from a fantasy to a reality in no time!

Published on 03/01/2024

Thinking about adding a co-signer to your home loan application? Here's what you need to know.

Published on 02/28/2024

If a less-than-perfect credit score is standing between you and homeownership, don't despair. There are still options available to help you secure a mortgage and achieve your dreams of owning a home. Let our experts guide you through the process and provide you with valuable tips and insights on how to improve your credit score and increase your chances of getting approved for a mortgage. With the right knowledge and guidance, homeownership can still be within reach, no matter your credit history.

Published on 02/27/2024

Are you tired of throwing money away on rent each month? Discover the hidden benefits of buying a home and start building your financial future today!

Published on 02/24/2024

Don't let your excitement blind you to these potential problems in a home your considering buying

Published on 02/21/2024

Our simplified mortgage process puts your clients on the fast track to their dream home. Find out how we can help you close more deals smoothly.

Published on 02/20/2024

Are you worried about fluctuating interest rates and unpredictable mortgage payments? Discover the stability and peace of mind of a fixed rate mortgage.

Published on 02/16/2024

What is FICO 8 and what role does it play in your mortgage application? Read this article to learn more.

Published on 02/14/2024

Are you tired of throwing away money on rent? Learn how homeownership can boost your financial standing & bring you happiness!

Published on 02/13/2024

Buying your first home is a significant milestone that comes with a mix of excitement and nerves. The real estate market can seem overwhelming, but with the right approach and preparation, you can navigate it successfully. Here are actionable tips for first-time home buyers to make the journey from saving for a down payment to securing a mortgage and closing on your new home a smooth one.

Published on 02/08/2024

Out with the old and in with the new! Here are the new rules for buying a home in the 2024 market.

Published on 02/07/2024

Embarking on the journey of homeownership is both exciting and daunting. One of the most critical aspects of this process is navigating the maze of mortgage acquisition. In this blog post, we will provide a comprehensive guide to demystify the mortgage process, ensuring you are well-prepared for this significant financial commitment.

Published on 02/06/2024

When embarking on the journey to homeownership, understanding mortgage rates and their impact on your home purchase is crucial. In this blog post, we'll explore how mortgage rates are determined, the different types available, and provide strategies to help you find the best rate for your situation.

Published on 02/01/2024

Mortgage rates are falling and there's a surprising benefit beyond a more affordable mortgage payment --more inventory! Read more in this latest blog.

Published on 01/31/2024

Navigating the path to homeownership can be complex, and a crucial aspect of this journey is understanding the role of credit in securing a mortgage. In this blog post, we'll explore how credit scores impact mortgage rates and approval, and provide practical tips for improving your credit score to secure favorable mortgage terms, especially for first-time home buyers.

Published on 01/30/2024

Looking to turn your dream home into a reality? We've got your back! With our simplified mortgage process, homeownership is no longer a distant dream. Say hello to stress-free borrowing and start packing those moving boxes!

Published on 01/25/2024

We're here to help make homebuying more afforable! Explore these tips for reducing your closing costs.

Published on 01/24/2024

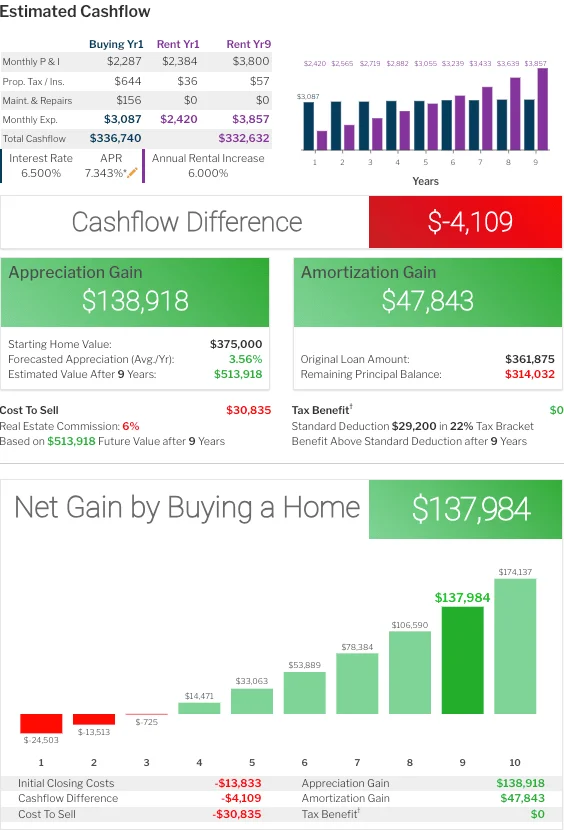

When it comes to choosing between renting and buying a home, the decision can have significant financial implications on both your current budget and long-term financial planning. In this blog post, we'll dive into a detailed comparison of the costs associated with renting versus buying, and how each option can impact wealth accumulation over time.

Published on 01/23/2024